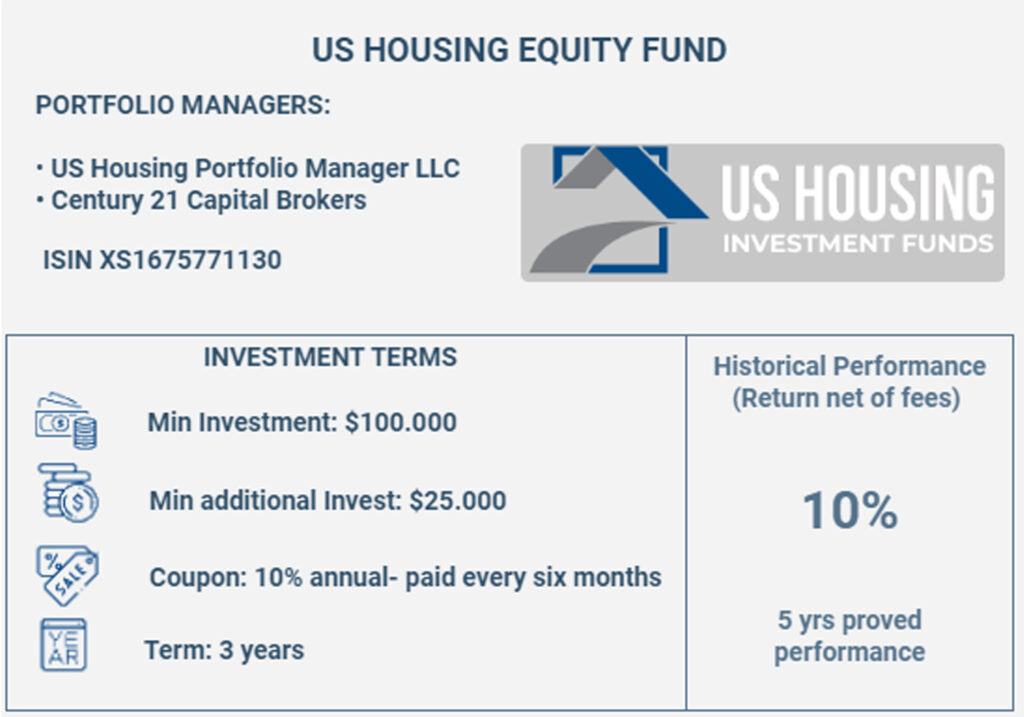

US Housing Equity Fund

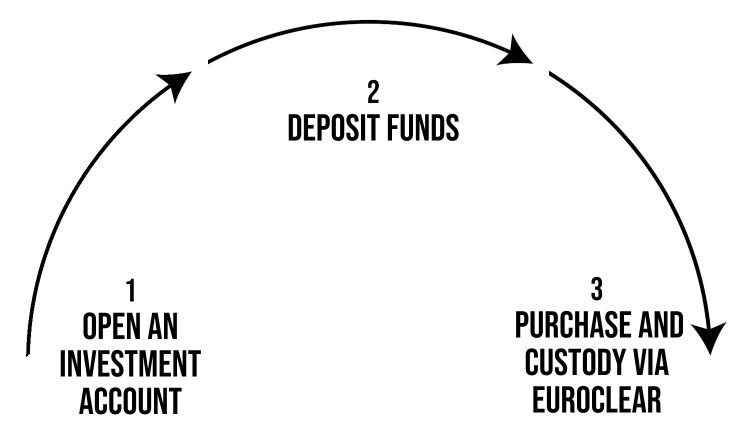

In order to give the option to investors to participate starting from US $100,000 the Fund issues its shares through ETP’s (Exchanged Traded Products). This financial vehicle consists of securities whose price and value are derived from the underlying assets. In this case, Structured Notes that has as collateral the titles of the properties that are being bought and sold.

The ETP’s are recognized assets in the International Exchange Markets and investors can buy them and sell them through their stock traders.

The Manager, on behalf of the Company, will strategically acquire, rehabilitate and sell real estate properties within the affordable housing price range.

The Company will also purchase vacant land to build homes within the affordable housing price range on a 12 month cycle between acquisition, construction and sales.

The portfolio consist of land and residential dwellings located in urban areas in South Florida, where affordable housing is likely to continue to attract government support and subsidies in the way of favorable financing opportunities.

Single family homes within affordable housing price range.

Income producing properties, residential and commercial.

Development and New Construction

PORTFOLIO MANAGER: US Housing Portfolio Manager LLC

ISSUE & PAYING AGENT: BNY Mellon

AUDITORS OF THE ISSUER: EisnerAmper

TRUSTEE: DMS

ISSUER: AlphaNotes

Driving the increase were a longstanding shortage of both new and existing homes combined with steady job and income growth that’s prompting more Americans to buy houses for the first time or trade up. “Home buyer demand is sky high, inventory levels are near rock bottom and home prices keep rising

- All

- Buy and Flip

Properties Rehab – 6336 Southwest 21st Street Miramar, FL 33023

Properties Rehab – 1400 North 67th Ter. Hollywood, FL 33024

Properties Rehab – 113 Sw 21 Way Fort Lauderdale, FL 33312

Properties Rehab – 138 SW 24 AVE Fort Lauderdale, FL 33312 – SOLD

Properties Rehab – 7001 Environ Blvd. Lauderhill, FL 33319

Properties Rehab – 132 SW 24 AVE Fort Lauderdale, FL 33312 – SOLD

Properties Rehab – 4130 SW 25th St. West Park, FL 33023

Properties Rehab – 3632 NW 30th Ct. Lauderdale Lakes, FL 33313

Properties Rehab – 121 Allen Rd. West Park, FL 33023

Properties Rehab – 1425 S 24th Ave. Hollywood, FL 33020.